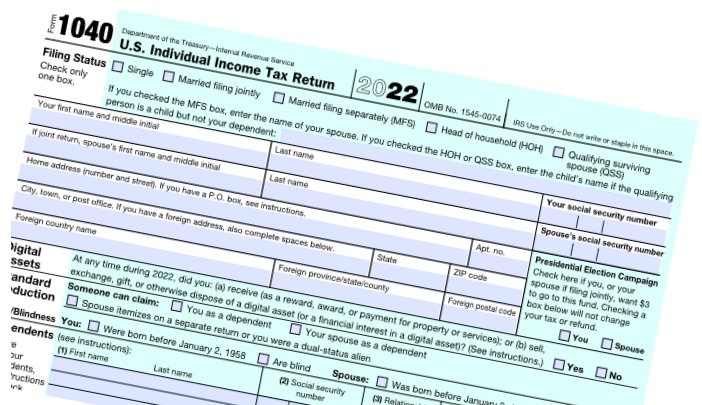

2024 Irs Home Office Deduction – If you worked remotely in 2023, you may be curious about the home office deduction. Here’s who qualifies for the tax break this season, according to experts. . Tax season — with its homeowner tax benefits — is one of the few times you may actually get some money out of your house instead of pouring money into it. Owning a house in the .

2024 Irs Home Office Deduction

Source : news.yahoo.comIRS: Here are the new income tax brackets for 2024

Source : www.cnbc.comIRS Mileage Rates 2024: What Drivers Need to Know

Source : www.everlance.comHere’s who qualifies for the home office deduction for 2023 taxes

Source : www.cnbc.com2024 Tax Brackets: IRS Reveals New Income Thresholds | Money

Source : money.comIRS: Here are the new income tax brackets for 2024

Source : www.cnbc.comIRS Sets 2024 Tax Brackets with Inflation Adjustments

Source : www.aarp.orgTax Season to Start January 29, 2024 CPA Practice Advisor

Source : www.cpapracticeadvisor.comWhen To Expect My Tax Refund? IRS Tax Refund Calendar 2024

Source : thecollegeinvestor.comHome Office Tax Deduction in 2024 New Updates | TaxAct

Source : blog.taxact.com2024 Irs Home Office Deduction IRS announces 2024 income tax brackets – see where you fall: While simple math errors don’t usually trigger a full-blown examination by the IRS, they will garner extra scrutiny and slow down the completion of your return. So can entering your Social Security . Working from home (commonly abbreviated as WFH) can offer a number of perks, from skipping the daily commute to wearing sweatpants all day long. But can the remote work setup also include tax .

]]>

.png)